Some financial advisors argue that even though their fees are calculated as a percentage of the assets under management (AUM), the fees are not literally going toward making trades. The fees actually cover financial planning services the advisor provides to the client as part of the full package. They say whether it’s an hourly fee, a monthly fee, a fixed fee, or a percentage-of-assets fee, ultimately the total fees can be backed into a percentage of assets. As a result, how the fee is calculated doesn’t really matter.

I’m fortunate to have reader Bill share with us candidly how it really works at a fee-only financial advisor firm where he works. Here’s an edited interview with Bill:

Please introduce yourself. What type of firm do you work at? What’s your role there?

I work for a medium-size fee-only Registered Investment Adviser firm. We are a fiduciary to our clients. I’m in a junior advisor/paraplanner role.

What’s the fee model at this firm? If I come in with $1 million, how much am I expected to pay?

Like most fee-only advisor firms, we charge a percentage of assets under management, with a tiered fee schedule. We deduct our fees from your accounts quarterly. If you come in with $1 million, our fees will be about $10,000 a year, give or take depending on asset value fluctuations at the end of each quarter.

What services do I get for paying $10,000 a year?

We give you comprehensive financial planning. We review all your accounts, your insurance policies, your employer retirement plans, your estate planning, your college funding, your retirement projections. We’ll also look to do some tax planning for the short, intermediate, and long term. We recommend a portfolio allocation based on your risk tolerance and goals. We transfer your accounts over to a custodian we use. We reallocate, and we rebalance. We meet with you 2-3 times a year to review your investment performance and do those planning tasks. You receive quarterly performance reports whether or not we meet in that quarter.

What if I’m not ready for comprehensive financial planning and I only want my money managed? Do I still pay the same $10,000 a year?

You still pay $10,000 a year. Our fees are calculated on your assets under management. We make ourselves available to you for comprehensive financial planning. It is our goal to be as comprehensive with the planning piece as possible, but at the end of the day, we can’t force you to provide us with the necessary information and/or implement our recommendations.

So I go for your comprehensive financial planning. How long does it take to go through everything?

It usually takes 2-3 years. It can take a shorter period in theory, but implementing the recommendations rarely happens quickly.

What happens after 2-3 years?

After 2-3 years and most of the major planning points have been taken care of, we simply review the comprehensive planning moving forward. The best example is reviewing your estate plan on an annual basis. If there was a major life change (marriage, the birth of a child, death, inheritance, etc.) then this would be very worthwhile. If you change jobs then we will want to review your new benefits package if you are willing to provide it. We will try to get you to maximize retirement contributions available to you. We are available to help you with one-off items, such as a mortgage refinance. If you are charitably inclined then we will look to assist you in executing that annually. We will hold your hand through market volatility.

And if there isn’t anything major?

We still get you into the office and show you that we are “working” for you. Maybe there is a takeaway where we help you do something else, but usually not. Investments/performance review is a part of every meeting. We then break the planning up as to always have something new to review over the course of a year. This is where the majority of our clients fall after a couple of years.

Do I still pay $10,000 a year after I fall into the review mode?

No. You will pay more than $10,000 a year now because in all likelihood your assets have grown from new contributions and/or investment gains.

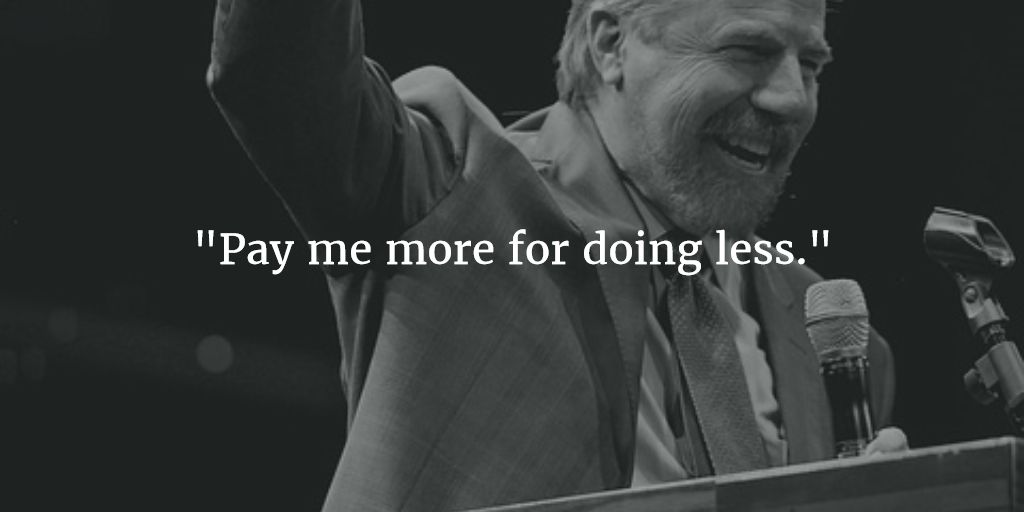

Wait. I paid $10,000 a year in the first couple of years and I got so much from you. Now I’m paying more for cruising on autopilot?

Yes. Our fees are based on assets under management. We are still managing your assets, although there really isn’t much to manage. We still make ourselves available to you for comprehensive financial planning. It’s not our fault you ran out of things to do and if we think of one or two things that make sense for your situation we will be sure to bring those up.

Nobody thought of paying for comprehensive financial planning upfront followed by a much-reduced fee for investment-only reviews?

We don’t offer that. Our clients don’t know it’s even an option elsewhere. If they contact other firms in the area they would be quoted assets-under-management fees not that different than ours. We linked our fees to assets under management from the get-go. As long as we are still managing their assets our clients don’t see we are doing less work in financial planning.

I thought as a fiduciary you are supposed to put my interest first?

Being a fiduciary and putting your interest first only means we don’t favor any product that pays us more than other products. Our fees are fully disclosed. We are not compelled to tell you how you can get the same or more value for less. However, if you aggressively take portfolio distributions and your assets fall below our minimum, we will start to charge you a minimum fee of $6,500. At that point, if the situation persists we are inclined to discuss other options with you as paying us the minimum fee may no longer be in your best interest based on your level of assets/outlook for wealth accumulation moving forward.

***

I thank Bill for giving us an honest and accurate picture of what really happens at a typical fee-only financial advisor firm. Fee-only advisors are supposedly the gold standard. You see how fees are calculated does matter. It anchors the clients’ expectations. When the fees are calculated on assets under management, clients don’t see it as buying financial planning services. They don’t see it when they pay more and receive less after a couple of years.

When compared to Advice-Only financial advisors (see How Much Does Advice-Only Cost?), a typical fee-only firm like the one Bill works at charges 2-3 times more in the first couple of years. After a couple of years, a typical fee-only firm charges upwards of 5-10 times more.

The more money you have, the more it makes sense to go with Advice-Only.